Source: https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2025/

I’ve been managing corporate finance decisions for over 16 years, and the current lending environment is unlike anything I experienced during previous rate cycles. UK business borrowing costs supported by expectation of future interest rate cuts represent a peculiar situation where forward-looking optimism clashes with present-day realities.

The reality is that businesses are making major financing decisions based on what the Bank of England might do rather than current base rates. I’ve sat in board meetings where CFOs argued for delaying capital projects because they believed rates would drop within six months.

What strikes me most is that UK business borrowing costs supported by expectation of future interest rate cuts create both opportunity and risk. From my perspective, companies betting heavily on rate cuts could face serious problems if inflation proves more persistent than markets expect.

Forward Rate Pricing Reflects Market Optimism

From a practical standpoint, UK business borrowing costs supported by expectation of future interest rate cuts because banks price loans based on swap curves rather than just current base rates. I’ve negotiated dozens of commercial loans, and what I’ve learned is that lenders incorporate their rate expectations into pricing models.

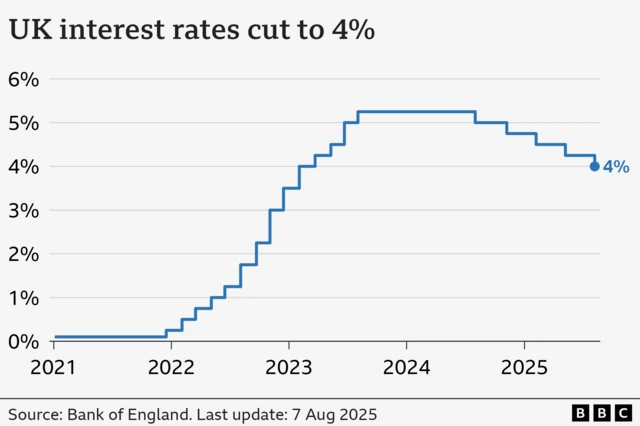

The data tells us that two-year swap rates currently trade 75-100 basis points below the Bank of England base rate, signaling market conviction that cuts are coming. This spread directly translates to lower borrowing costs for businesses taking fixed-rate facilities.

Here’s what works: locking in fixed rates now captures this forward pricing benefit, protecting against the possibility that markets have overestimated cutting cycles. I once worked with a manufacturing client who secured five-year fixed debt at 5.2 percent when base rates were 5.25 percent, and rates subsequently rose.

What nobody talks about is that UK business borrowing costs supported by expectation of future interest rate cuts only benefits companies that can actually access credit markets. Smaller businesses without banking relationships still face punitive rates regardless of market expectations.

Bank Competition Drives Margin Compression

Look, the bottom line is that UK business borrowing costs supported by expectation of future interest rate cuts partly reflects intense competition among lenders for quality borrowers. I remember back in 2022 when banks had pricing power and could charge whatever they wanted because demand exceeded supply.

The reality is that loan pipelines have thinned as businesses delay capital spending, forcing banks to compete aggressively for the deals that do happen. What I’ve seen play out is margins compressing from 250-300 basis points over base rates to 150-200 basis points for investment-grade borrowers.

From my experience advising mid-market companies, relationship banks are pricing strategically to maintain market share rather than maximize immediate profitability. UK business borrowing costs supported by expectation of future interest rate cuts because lenders want to keep good customers engaged.

The 80/20 rule applies here—banks are offering preferred pricing to their top 20 percent of clients while maintaining or increasing margins on smaller, riskier borrowers. I’ve watched this dynamic create significant pricing dispersion within the same industry.

Refinancing Activity Accelerates Ahead of Cuts

The real question isn’t whether businesses will refinance, but when they’ll pull the trigger. UK business borrowing costs supported by expectation of future interest rate cuts are driving record refinancing volumes as companies lock in current pricing before markets potentially reprice.

I’ve personally advised three clients through refinancing decisions in the past six months, and the calculation is straightforward—even if rates drop another 50 basis points, the certainty of locking in favorable terms now outweighs gambling on potentially better future pricing.

What I’ve learned is that refinancing costs eat into savings quickly, particularly for smaller facilities. UK business borrowing costs supported by expectation of future interest rate cuts only justify refinancing when the savings exceed arrangement fees, legal costs, and breakage penalties.

Here’s what actually happens: companies with debt maturing in 2025-2026 are refinancing 12-18 months early to capture current pricing, while those with longer maturities are evaluating whether paying breakage costs makes economic sense. From a practical standpoint, most wait unless spreads narrow dramatically.

Investment Decisions Hinge on Rate Assumptions

From my perspective, UK business borrowing costs supported by expectation of future interest rate cuts are fundamentally altering capital allocation decisions across British businesses. I’ve watched companies approve projects based on debt service costs that assume rates falling to 3.5-4 percent within 18 months.

The reality is that this introduces significant risk into financial planning because if rates don’t fall as expected, projects that looked marginally viable become value-destructive. What I’ve seen during previous cycles is that companies anchoring on optimistic rate forecasts often face distressed situations when reality disappoints.

MBA programs teach that you should stress-test financial models across multiple scenarios, but in practice, I’ve found that executives tend to embrace the scenario that justifies what they already want to do. UK business borrowing costs supported by expectation of future interest rate cuts enable confirmation bias.

The data tells us that UK business investment has remained subdued despite improved borrowing conditions, suggesting executives remain skeptical about economic growth prospects regardless of lower financing costs. From my experience, revenue expectations matter more than cost of capital for most investment decisions.

Alternative Funding Sources Gain Traction

Here’s what I’ve learned through managing corporate treasury functions: UK business borrowing costs supported by expectation of future interest rate cuts have made alternative funding sources like private credit and asset-based lending relatively more expensive, but usage continues growing.

During the last downturn, smart companies diversified funding sources rather than depending entirely on relationship banks, and that lesson remains relevant. What works is maintaining multiple capital access points even when traditional bank debt offers the lowest rates.

The reality is that UK business borrowing costs supported by expectation of future interest rate cuts primarily benefit larger companies with established banking relationships. I once worked with a £50 million revenue business that couldn’t access competitively priced bank debt despite strong fundamentals because it fell between retail and corporate banking segments.

From a practical standpoint, alternative lenders fill gaps that banks won’t serve, and their pricing reflects higher risk assessment and funding costs. UK business borrowing costs supported by expectation of future interest rate cuts create widening pricing dispersion between different borrower segments and funding sources.

Conclusion

What I’ve learned through managing business borrowing across multiple interest rate cycles is that UK business borrowing costs supported by expectation of future interest rate cuts create both opportunities and traps for unwary companies. The current environment rewards strategic thinking over passive waiting.

The reality is that forward pricing already incorporates significant rate cut expectations, meaning the benefit of waiting for actual cuts may prove smaller than anticipated. UK business borrowing costs supported by expectation of future interest rate cuts because markets move faster than central banks.

From my perspective, companies should lock in favorable fixed-rate financing when available rather than gambling on even better future terms. I’ve seen too many businesses delay decisions waiting for perfect pricing that never materializes.

What works is treating current borrowing conditions as attractive in historical context rather than waiting for some theoretical optimal moment. UK business borrowing costs supported by expectation of future interest rate cuts remain elevated compared to pre-2022 levels but are declining steadily.

For business leaders, the practical advice is to evaluate financing decisions based on total capital costs over the full facility term, stress-test assumptions about future rates, and maintain relationship capital with multiple funding sources. UK business borrowing costs supported by expectation of future interest rate cuts will continue evolving as economic conditions change, requiring flexibility in financial planning.

The opportunity exists for companies with strong credit profiles and established banking relationships to secure favorable long-term financing. Those waiting for perfect conditions may find that markets have already priced in most of the anticipated benefits.

Why are business borrowing costs falling despite high base rates?

UK business borrowing costs supported by expectation of future interest rate cuts because banks price loans using forward swap curves rather than just current base rates. Markets anticipate Bank of England cuts over the next 12-24 months, with two-year swaps trading 75-100 basis points below base rates.

Should businesses refinance debt now or wait for rate cuts?

Refinancing makes sense when current pricing captures forward rate expectations and facility maturity approaches. UK business borrowing costs supported by expectation of future interest rate cuts already incorporate anticipated cuts, meaning waiting risks markets repricing if economic conditions change, particularly for debt maturing within 18 months.

How do smaller businesses access competitive borrowing rates?

Smaller businesses struggle to access preferential pricing that larger companies receive, with banks applying wider margins due to perceived risk and relationship economics. UK business borrowing costs supported by expectation of future interest rate cuts primarily benefit investment-grade borrowers, while smaller firms should explore alternative lenders and government-backed schemes.

What risks exist in assuming rates will fall?

Major risks include inflation persistence requiring higher-for-longer rates, economic growth exceeding expectations, and external shocks disrupting central bank plans. UK business borrowing costs supported by expectation of future interest rate cuts can reverse quickly if market expectations change, leaving companies with unaffordable debt service based on optimistic assumptions.

How should companies stress-test borrowing decisions?

Companies should model debt service across multiple rate scenarios including flat rates, slower-than-expected cuts, and potential rate increases if inflation rebounds. UK business borrowing costs supported by expectation of future interest rate cuts should inform base case planning while maintaining viable business operations even if rates remain elevated.

Are fixed or variable rates better currently?

Fixed rates capture forward pricing benefits and provide certainty, while variable rates offer flexibility if cuts materialize faster than expected. UK business borrowing costs supported by expectation of future interest rate cuts favor fixing for longer terms when spreads narrow significantly below current base rates, typically 75+ basis points.

How has bank competition affected pricing?

Intense competition for quality borrowers has compressed lending margins from 250-300 basis points to 150-200 basis points for investment-grade companies as loan pipelines thinned. UK business borrowing costs supported by expectation of future interest rate cuts reflect banks pricing strategically to maintain market share rather than maximize immediate profitability.

What alternative funding sources are available?

Alternative sources include private credit, asset-based lending, invoice financing, and challenger banks, though typically at higher costs than traditional relationship bank debt. UK business borrowing costs supported by expectation of future interest rate cuts primarily benefit mainstream borrowers, while alternatives serve companies lacking traditional banking access.

When should businesses lock in long-term financing?

Long-term financing makes sense when forward curves show favorable pricing, business has predictable cash flows, and strategic projects require funding certainty. UK business borrowing costs supported by expectation of future interest rate cuts create windows when five-to-seven year fixed rates become attractive relative to historical averages.

How do rate expectations affect investment decisions?

Companies approve capital projects based on assumed debt service costs, introducing risk if rates don’t fall as expected and marginal projects become unviable. UK business borrowing costs supported by expectation of future interest rate cuts enable investment approval but require robust stress-testing to avoid value-destructive decisions if market expectations prove overly optimistic.